Beyond the Stock Market How to Start Investing in Fractional Real Estate This Month

What Fractional Real Estate Actually Is

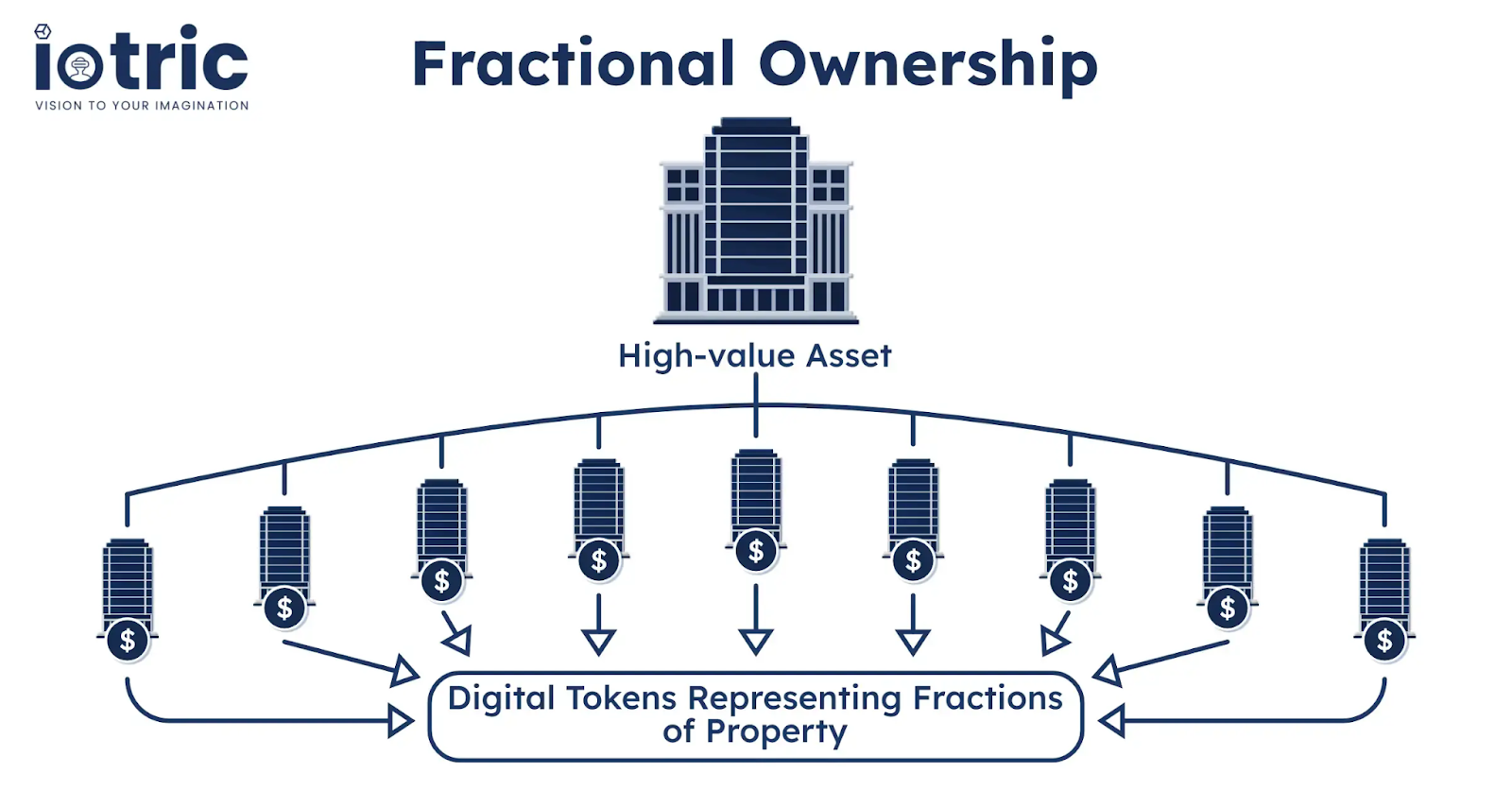

Instead of purchasing an entire unit, you are purchasing an ownership interest (often in the form of shares, tokens or units) through a regulated company that has established a structured investment method of offering ownership rights in the property.

You do not qualify as a landlord in the traditional sense under this type of transaction. The company you purchased your shares through (e.g., the regulated company) or the parent company purchasing the shares will be responsible for these functions:

- Finding and assessing potential rental properties for investments

- Selecting and managing tenants as well as maintaining the property

- Paying rental income to investors on a monthly or quarterly basis.

Many companies in the fractional real estate investment space are using blockchain technology to tokenize ownership of rental properties, which significantly simplifies the buying and selling of fractional ownership, has contributed to the increase in demand for tokenized rental properties and is predicted to generate close to twenty billion dollars in financing by 2033.

Why Investors Are Paying Attention Now

If your investment mix is heavily invested in equity and cash, then considering fractional real estate investing can provide you with an entirely new risk/return profile without needing to invest six figures in capital.

Factors that are driving this interest include the following:

- Min is low on some platforms that start at $50 - $100, so you can begin testing the waters this month vs "someday."

- The average age of fractional real estate investors is under 40, approximately 60% of all fractional investors are under 40.

- You will have access to properties that you could not purchase outright, such as Single Family Rentals (SFR), vacation houses, suburban growth markets, etc.; however, these properties will be curated and underwritten on your behalf.

Most fractional platforms offer property level exposure and some decision rights compared to owning a share of a large pool, compared to REITs.

Step 1: Get Clear on Your Goal (Before You Click “Invest”)

Before you start using any app, determine what your goals are regarding fractional real estate investing.

~If you want income now, look for stabilized rentals with clearly defined yield profiles and regular dividend schedules (monthly or quarterly).

~If you're looking for long-term growth, you'll want to invest in emerging secondary/suburban markets or value-add deals and be prepared for more volatility.

~If you want to diversify your investments, it will be more important to have smaller positions in multiple properties and geographical areas, rather than trying to find that one "perfect" deal.

This is a very basic principle, but it will help you avoid investing in real estate in the same way that you would invest in "meme stocks."

Step 2: Pick the Right Platform for You

Not every fractional real estate investment website works in the same manner. A few tips for a business minded standpoint

- Initial Investment And Liquidity Options: With a more affordable initial investment and secondary market trade opportunities, this is ideal. With a higher initial investment and multi-year hold periods, this is a poor choice;

- Types Of Property Available: With a minimal initial investment, this is ideal; with a larger initial investment, this is a poor choice, such as a multi-family property or single-family home;

- Fees: May wary of all fee disclosures and look for clear and understandable fee disclosure;

- Governance: It determines if the site allows you to vote on significant management decisions, such as selling, refinancing, significant capital improvements, etc.;

If you are considering a real estate investment, you need to treat the selection of a platform as a potential partner in your business, meaning that you should evaluate the platform's historical performance, the transparency of the platform and the regulatory framework of the platform.

Step 3: Start Small, Then Diversify Intentionally

The first fractional ownership you purchase on a platform doesn’t need to be monumental; it’s an experiment performed live with real money.

- Pick a reasonably modest ticket size (whatever “non-painful” means for you)for your first fractional purchase.

- Select one or two properties with different characteristics (for example, you may choose to own both a stable residential rental and a space in a fast-growing area).

- Observe how the cash flow, reports, and communication occur over time (minimum 3 months) to see how they affect you.

Once you have a positive experience, you will want to add more fractional investments to your portfolio. A reasonable way to start is to own about 4-5 properties in 2+ markets, from 2 or more different platforms. This will give you enough diversification so that even if one of these properties or one of these platforms has poor performance, you are not too exposed to any one manager, market, or regulatory environment.

Step 4: Respect the Risks (This Is Still Real Estate)

While fractional real estate transactions are well designed, there is still friction that can arise in the real world:

- A property can have vacancies, require significant cost repairs, or not achieve rental income as predicted in the pro-forma.

- Fractional real estate transactions are generally much less liquid than publicly traded REITs, even if a so-called second marketplace exists. You may not be able to sell the property when you want to (at the price you wish to receive).

- Legal and tax issues can become very complex, especially when you are dealing with a cross-border transaction that is tokenized; different jurisdictions may interpret and enforce their taxation and securities laws.

If you are investing a significant amount of capital, it may be prudent to consult with a tax or legal professional as soon as possible—in order to have the best chance at a successful transaction.

Step 5: Make It Part of a Bigger Plan

Bragging about having ownership of only 0.15% of a downtown duplex wouldn't be a real win; rather it is about incorporating fractional real estate as part of your overall allocation based on your income, risk appetite, and time horizon.

For digital-first, business-aware investors, this may look like:

- A core of index funds or ETFs

- A small portion in fractional real estate investing as a source of income and diversification

- Some higher-risk investments (startups, crypto, sector investments) on top

If you want to buy a property this month, you don't need a 50-page plan. You need one platform, one goal, and one small, well-chosen property first. The discipline will come from what you do after that.